Running a business is tough work. There are so many areas to handle – from product development, customer service, marketing, and accounting. That’s why we are lucky to have experts like Reberca David to help us navigate the ins and outs. Reberca is an entrepreneur, tax accountant, and author of Entrepreneurship 101: The Things Your CPA Wants You to Know Regarding Your Business. She shares her insights and experience in accounting and entrepreneurship to give us the knowledge we need to succeed. Aspiring entrepreneurs, business owners, and anyone looking to learn – read on to find out more!

Reberca David, the esteemed proprietor of R. David & Associates LLC, is a highly accomplished accountant based in Fort Lauderdale. Graduating with a Bachelor’s degree in Marketing and Business Management from Florida Atlantic University in 2016, she embarked on her accounting journey and swiftly garnered extensive experience in tax preparation and the accounting field for over seven years. In 2020, she attained her CPA license, further solidifying her expertise.

Reberca David, the esteemed proprietor of R. David & Associates LLC, is a highly accomplished accountant based in Fort Lauderdale. Graduating with a Bachelor’s degree in Marketing and Business Management from Florida Atlantic University in 2016, she embarked on her accounting journey and swiftly garnered extensive experience in tax preparation and the accounting field for over seven years. In 2020, she attained her CPA license, further solidifying her expertise.

With a deep understanding of complex financial matters, Reberca will craft tailored strategies to maximize your wealth and minimize tax liabilities. From sophisticated tax planning to comprehensive financial management, she offer a personalized approach that aligns with your unique goals.

Distinguished by her exceptional accomplishments, Reberca takes immense pride in being one of the rare black CPAs, with less than 2% of CPAs in the United States belonging to this community. Her unique perspective and innovative mindset empower her to provide clients with cutting-edge tax strategies that deliver remarkable outcomes. Embrace the opportunity to collaborate with Reberca David and unlock new dimensions of financial success while enjoying personalized service and expert guidance. Learn more by visiting https://rdavidassociates.com/

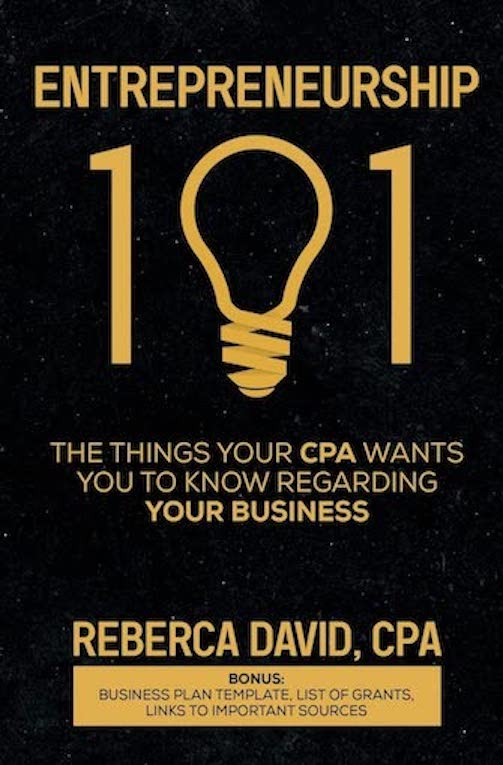

Entrepreneurship 101: The Things Your CPA Wants You to Know Regarding Your Business

Embarking on the path of entrepreneurship can be both exhilarating and daunting. As you step into the world of business ownership, you’re faced with a myriad of challenges that require insight, knowledge, and a clear roadmap. “Entrepreneurship 101: The Things Your CPA Wants You to Know Regarding Your Business” is your guiding light, illuminating the crucial aspects of business ownership, demystifying complex financial matters, and providing the support you need to navigate the entrepreneurial journey with confidence.

Authored by a seasoned Certified Public Accountant (CPA), this comprehensive book is the ultimate companion for every aspiring entrepreneur. From the foundational principles to the intricacies of running a successful business, every page is filled with valuable insights that will empower you to make informed decisions, maximize profits, and alleviate the stress that often accompanies business ownership. Purchase Entrepreneurship 101 on Amazon https://amzn.to/3QtQYvJ

What inspired you to write this book, “Entrepreneurship 101: The Things Your CPA Wants You To Know Regarding Your Business,” and how it can benefit aspiring entrepreneurs and small business owners? I was inspired to write “Entrepreneurship 101” based on my experience collaborating with numerous young businesses. I’ve seen many of them make avoidable financial mistakes that can be quite costly. This book is a comprehensive guide to help aspiring entrepreneurs and small business owners navigate the complex world of business. It provides valuable insights, practical advice, and strategies to establish a strong financial foundation and succeed in the competitive business landscape.

In the book, you emphasize the importance of financial management for entrepreneurs. Could you share some key financial principles or LPS that entrepreneurs should be aware of? Financial management is the backbone of any successful business. In “Entrepreneurship 101,” I stress several key financial principles. Firstly, it’s essential to maintain accurate and up-to-date financial records. This not only helps you make informed decisions but also ensures compliance with tax regulations. Secondly, effective budgeting is crucial. You should create a detailed budget that outlines your income and expenses. Monitor it regularly and adjust as needed.

Lastly, managing cash flow is paramount. Understand when your business is most likely to have high or low cash flow and plan accordingly.

What are some common financial pitfalls that entrepreneurs often face, and how can they avoid them? Entrepreneurs frequently stumble into the pitfall of mixing personal and business finances. To avoid this, open a separate business bank account, use business credit cards for company expenses, and maintain clear financial boundaries. Another pitfall is neglecting to plan for taxes. To steer clear of this, set aside a portion of your income for taxes and consider hiring a tax professional. Finally, overspending can be detrimental. Carefully scrutinize expenses and invest wisely in areas that drive growth.

Inside “Entrepreneurship 101,” you’ll discover:

-

- Financial Clarity: Gain a deep understanding of the financial aspects of your business, from managing taxes and accounting to effective payroll management and strategic tax planning. You’ll learn how to navigate the financial landscape with ease, allowing you to focus on growing your business.

- Comprehensive Coverage: This book doesn’t leave any stone unturned. It goes beyond the basics to cover essential topics such as marketing, auditing, and more. You’ll be equipped with the knowledge to develop robust strategies that drive your business forward.

- Tax-Saving Strategies: Discover actionable insights on how to reduce your tax burden legally and efficiently. You’ll learn valuable techniques to optimize your tax position, ultimately increasing your bottom line.

- Stress Alleviation: Running a business is undoubtedly stressful. “Entrepreneurship 101” recognizes this and offers practical solutions to ease that burden. By having a CPA as your guide, you’ll have a trusted partner by your side, ready to provide clarity and support in the face of uncertainty.

- Practical Wisdom: Backed by real-world experience, this book offers practical wisdom that you can apply immediately. It’s not just theory; it’s a hands-on guide to thriving in the competitive business landscape.

“Entrepreneurship 101: The Things Your CPA Wants You to Know Regarding Your Business” is more than a book; it’s your mentor, your advisor, and your confidant as you navigate the challenges and triumphs of entrepreneurship. No longer do you have to face the complexities of starting and running a business in the dark. This book will empower you, ensuring that you have the knowledge and support needed to succeed.

If you’re ready to embark on a journey of business success, financial empowerment, and stress reduction, this book is your indispensable companion. Grab your copy of “Entrepreneurship 101” today and take the first step towards a brighter, more confident future as a successful entrepreneur.

If you’re ready to embark on a journey of business success, financial empowerment, and stress reduction, this book is your indispensable companion. Grab your copy of “Entrepreneurship 101” today and take the first step towards a brighter, more confident future as a successful entrepreneur.

One of the topics in your book is understanding financial statements. Can you explain why this is crucial for entrepreneurs, and what should they look for when reviewing their financial statements? Understanding financial statements is vital for entrepreneurs as it provides a clear picture of their business’s financial health. Entrepreneurs should focus on key components of financial statements, including the balance sheet, income statement, and cash flow statement. Analyze your company’s liquidity, profitability, and overall financial performance. Pay attention to trends over time. This insight allows you to make informed decisions, secure financing, and demonstrate your business’s financial stability to potential investors or partners.

The title mentions what a CPA wants entrepreneurs to know. Could you elaborate on what CPAs commonly encounter when working with small business clients and how entrepreneurs can collaborate effectively with their CPAs? CPAs often encounter disorganized financial records, improper tax classifications, and inadequate preparation for audits. Entrepreneurs can collaborate effectively with their CPAs by maintaining organized financial records, understanding their industry-specific tax requirements, and proactively seeking advice on tax planning. Regular communication is key – provide your CPA with all relevant financial information and keep them informed of any significant business changes or transactions. Purchase Entrepreneurship 101 on Amazon https://amzn.to/3QtQYvJ

Managing taxes is a significant concern for entrepreneurs. What are some tax strategies or considerations that entrepreneurs should keep in mind to optimize their financial situation? Entrepreneurs can optimize their tax situation by exploring tax deductions and credits specific to their industry. For instance, research and development tax credits can benefit tech startups.

Additionally, consider tax-advantaged retirement plans like SEP IRAs or Solo 401(k)s. Keep track of eligible business expenses, and, if applicable, consider incorporating to benefit from more favorable tax treatment.

Could you share an example or case study from the book that illustrates a business’s financial challenges and how they were overcome with the advice presented in “Entrepreneurship 101?” Certainly. In one case study, a small e-commerce business faced cash flow problems due to inconsistent sales. Following the book’s guidance, the business owner implemented a budget, reduced unnecessary expenses, and explored financing options like a line of credit to cover seasonal fluctua:ons in cash flow. By carefully managing their finances, they overcame cash flow challenges and sustained their business.

Financing is often a challenge for startups. Can you provide insights on different funding options available to entrepreneurs, including the pros and cons of each? Absolutely. Startups can consider various funding options, including bootstrapping, angel investors, venture capital, loans, or crowdfunding. Each option has its pros and cons.

Bootstrapping offers full control but limited resources. Angel investors provide capital and expertise but may require equity. Venture capital offers substantial funding but often involves giving up a significant portion of ownership. Loans come with interest and repayment obligations. Crowdfunding leverages public support but may require extensive marketing efforts. The right choice depends on your business’s needs and goals.

Marketing and growth are crucial aspects of entrepreneurship. How does financial management tie into these areas, and what strategies do you suggest for sustainable business growth? Effective financial management enables you to allocate resources for marketing and growth. Create a marketing budget to ensure your promotional efforts align with your financial capacity. Additionally, reinvest profits into marketing and expanding your product or service offerings.

Focus on measuring marketing ROI to allocate resources wisely. Sustainable growth oUen involves diversifying revenue streams, expanding your customer base, and maintaining a keen eye on profitability.

The business landscape is constantly evolving. How does your book address adapting to economic changes and disruptions, such as those seen during the COVID-19 pandemic? Adapting to economic changes is crucial for survival. “Entrepreneurship 101” discusses contingency planning and building financial resilience. It emphasizes the importance of emergency funds, financial forecasting, and exploring alternative revenue streams. During the COVID-19 pandemic, businesses that swiftly adjusted their strategies and financial plans were better equipped to weather the storm. The book provides guidance on these adaptive strategies.

You mention the importance of budgeting in the book. Can you provide some practical steps for entrepreneurs to create an effective budget for their businesses? To create an effective budget, start by listing all income sources and anticipated expenses. Be thorough and realistic in your estimations. Differentiate between fixed and variable costs.

Review historical financial data for insights. Continuously monitor and adjust the budget as circumstances change. Allocate funds for essential expenses, debt repayment, and savings. A well-structured budget keeps your business on track and helps you make informed financial decisions.

In today’s digital age, what role does technology and financial software play in helping entrepreneurs manage their finances effectively? Technology and financial software are invaluable for entrepreneurs. They streamline financial tasks, automate bookkeeping, and provide real-time financial insights. Choose accounting software that suits your business needs. It simplifies tasks like invoicing, expense tracking, and financial reporting. Additionally, digital tools can help you manage online sales, marketing analytics, and customer relationship management. Embracing technology enhances efficiency and ensures your financial records are accurate and up-to-date.

What are some key takeaways or actionable advice you hope readers will gain from reading “Entrepreneurship 101”?Everything in the book were conversations I would have over and over with clients. Many books out there are motivational books talking about why you should start a business, when you should start a business, and what business you should start. But no one talks about how to go about it. What are the steps to starting a business, how do I go about taxes, what are financial statements?

As a final thought, what is one piece of advice you would give to aspiring entrepreneurs who are just starting their journey, based on the wisdom shared in your book?One piece of advice I would give to entrepreneurs is to not ignore your finances. It is the most integral part of your business. If you’re not good with money, get good with money. Seek the help of professionals, read books, watch YouTube videos, do what you need to do to educated yourself. And most importantly, do not neglect you taxes.

Purchase Entrepreneurship 101 on Amazon https://amzn.to/3QtQYvJ

Learn more by visiting https://rdavidassociates.com/

Building a successful business involves having a comprehensive understanding of how your finances work. At the heart of this is having a good understanding of financial statements, cash flow, and taxes. Reberca David’s Entrepreneurship 101: The Things Your CPA Wants You to Know Regarding Your Business offers a comprehensive guide to financial management for entrepreneurs. By reading her book, business owners will be able to optimize their finances, free up time to focus on their business, and most importantly, set themselves up for success. Thanks to Reberca for sharing her insights! Whether you are starting out or looking to grow, Reberca’s advice on accounting, entrepreneurship, and business management is invaluable.